How Current Adjustments in Insurance Rules Affect Your Coverage

Wiki Article

The Duty of Insurance Policy in Financial Preparation: Securing Your Properties

Value of Insurance in Financial Preparation

Insurance coverage plays a crucial role in a person's financial preparation approach, working as a secure versus unexpected events that could endanger financial stability. By reducing risks related to wellness problems, building damage, or liability cases, insurance supplies an economic safeguard that permits individuals to keep their financial wellness also in negative conditions.The importance of insurance coverage expands beyond simple economic protection; it likewise cultivates lasting economic discipline. Routine premium repayments urge individuals to spending plan successfully, guaranteeing that they designate funds for potential dangers. Certain insurance policy items can offer as financial investment vehicles, contributing to wealth buildup over time.

Additionally, insurance coverage can improve an individual's capacity to take computed dangers in various other locations of economic preparation, such as entrepreneurship or investment in realty. Recognizing that there is a safety internet in area enables higher confidence in going after opportunities that might or else appear daunting.

Ultimately, the integration of insurance policy right into economic planning not only safeguards assets but likewise assists in a more durable financial approach. As individuals navigate life's unpredictabilities, insurance coverage stands as a fundamental component, allowing them to preserve and construct wide range over the lengthy term.

Kinds Of Insurance Policy to Take Into Consideration

When examining a comprehensive economic plan, it is necessary to think about various kinds of insurance policy that can address various aspects of risk administration. Each type offers a distinct purpose and can secure your possessions from unpredicted events.Health insurance coverage is crucial, covering medical expenditures and safeguarding against high medical care prices - insurance. Homeowners insurance policy secures your home and belongings from damages or burglary, while also supplying obligation coverage in situation a person is harmed on your premises. Automobile insurance policy is important for vehicle proprietors, providing protection versus damages, burglary, and obligation for injuries received in mishaps

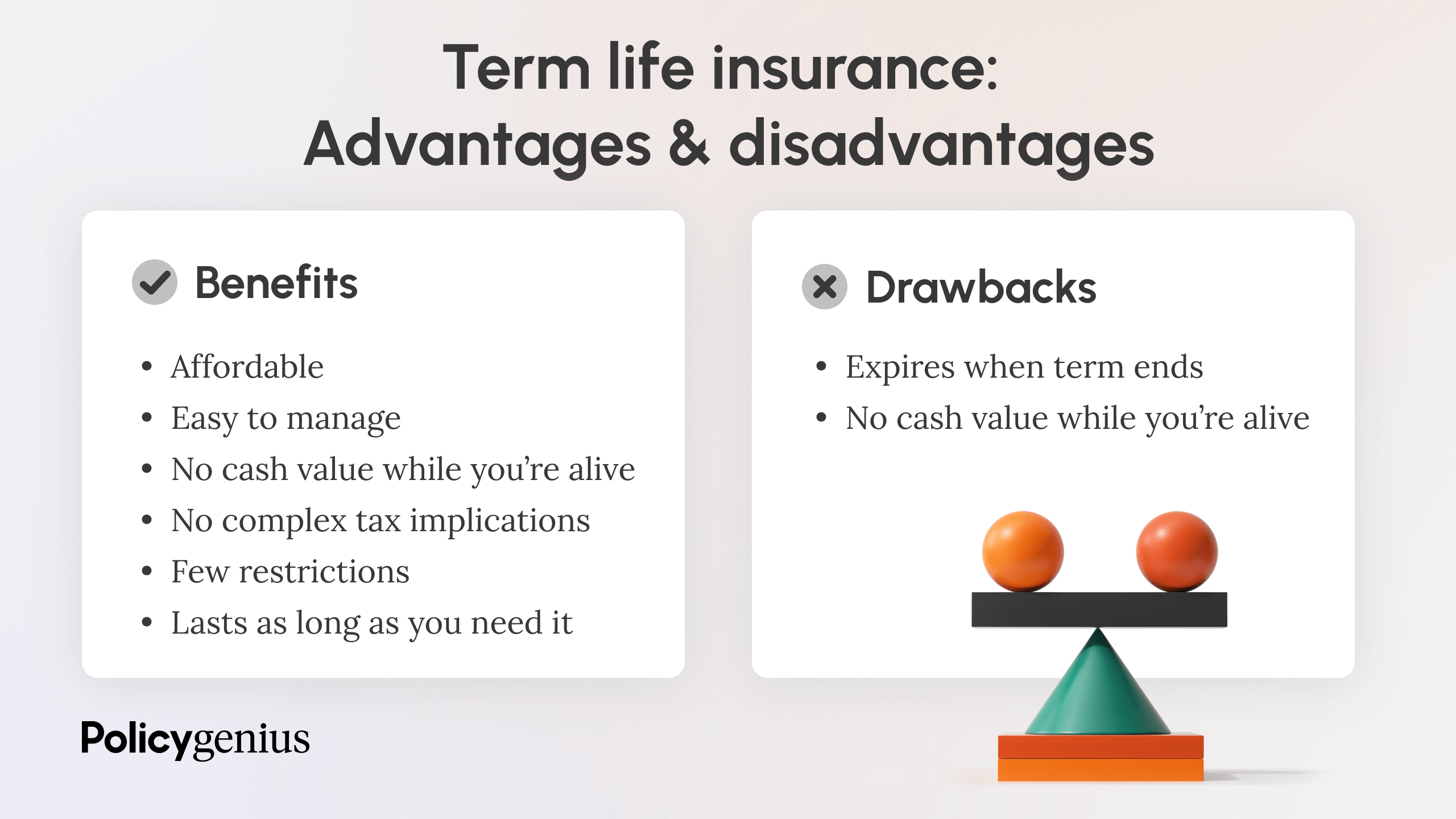

Life insurance provides financial safety for dependents in the occasion of an unforeseen death, ensuring their requirements are met. Special needs insurance coverage is equally crucial, as it changes lost earnings during periods of disease or injury that stop you from functioning. Additionally, umbrella insurance policy provides added liability coverage beyond common policies, supplying an included layer of protection against substantial cases.

Evaluating Your Insurance Policy Demands

Identifying the appropriate level of insurance protection is a crucial step in securing your economic future. To examine your insurance coverage requires properly, you must begin by evaluating your existing possessions, responsibilities, and general economic goals. This involves thinking about variables such as your earnings, financial savings, financial investments, and any kind of debts you might have.Following, determine possible risks that could influence your monetary stability. For instance, analyze the possibility of occasions such as disease, mishaps, or building damages. This risk assessment will help you figure out the kinds and quantities of insurance policy needed, including health, life, vehicle, homeowner, and special needs's insurance policy.

Furthermore, consider your dependents and their economic demands in the occasion of your unfortunate passing away - insurance. Life insurance might be essential for guaranteeing that liked ones can maintain their lifestyle and fulfill economic commitments

Integrating Insurance Policy With Investments

Incorporating insurance coverage with investments is a critical method that boosts financial safety and security and development capacity. By aligning these two vital components of monetary preparation, people can create a much more durable economic portfolio. Insurance policy products, such as my blog entire life or universal life policies, usually have a financial investment element that permits policyholders to collect cash value over time. This double benefit can act as a security web while likewise adding to long-term wealth structure.Additionally, integrating life insurance policy with investment techniques can supply liquidity for recipients, guaranteeing that funds are available to cover prompt expenditures or to spend even more. This synergy enables a much more detailed danger administration method, as insurance can shield versus unanticipated scenarios, while financial investments function in the direction of attaining monetary objectives.

Furthermore, leveraging tax obligation advantages associated with particular insurance policy items can improve general returns. As an example, the cash money worth development in long-term life insurance plans might grow tax-deferred, offering a special benefit contrasted to standard financial investment lorries. Successfully integrating insurance policy with financial investments not only safeguards possessions but additionally makes best use of development possibilities, resulting in a durable financial strategy tailored to individual requirements and goals.

Common Insurance Coverage Myths Debunked

False impressions about insurance policy can significantly impede reliable monetary preparation. One prevalent myth is that insurance is an unnecessary cost. In truth, it functions as an important safeguard, shielding properties and making sure financial stability in times of unexpected occasions. Many people additionally believe that all insurance coverage coincide; nonetheless, coverage can differ extensively based upon the copyright and details terms. This difference highlights the importance of comprehending plan information before deciding.One more usual myth is that more youthful people do not need life insurance coverage. In addition, some think that wellness insurance coverage covers all clinical expenditures, which is not the situation.

Last but not least, the idea that insurance policy is just helpful throughout emergencies ignores its function in proactive economic planning. By including insurance coverage into your technique, you can secure your possessions and improve your total monetary strength. Resolve these misconceptions to make educated choices and maximize your financial planning efforts.

Conclusion

In verdict, insurance policy serves as a basic part of effective monetary planning, giving crucial security against unforeseen threats and adding to possession safety. By basics comprehending different types of insurance and analyzing private requirements, one can accomplish a well balanced monetary technique.In the realm of financial planning, insurance coverage offers as a keystone for guarding your assets and making certain lasting stability.The significance of insurance extends past simple financial protection; it additionally fosters long-lasting economic discipline.False impressions about insurance can considerably impede efficient monetary preparation.Lastly, the belief that insurance policy is only advantageous during emergencies ignores its function in aggressive monetary preparation.In conclusion, insurance coverage offers you could try these out as an essential part of effective monetary planning, providing crucial defense versus unexpected threats and adding to property safety.

Report this wiki page